Are You Ready For The Rise In Auto-Enrolment Contributions?

Automatic-enrolment pensions were introduced by the coalition government in 2012 to plug the retirement income gap.

And the scheme’s been very successful — over 8.8 million employees have now been enrolled into a workplace pension by 850,000 employers. That’s roughly 90% of eligible workers.

It remains one of the most tax-efficient ways of saving towards retirement, partially mitigates the declining value of the state pension and allows employers to offer workers more security in challenging times.

Major changes to the scheme are coming very soon, with employer and employee contributions set to rise this April and in April 2019.

Rising contributions

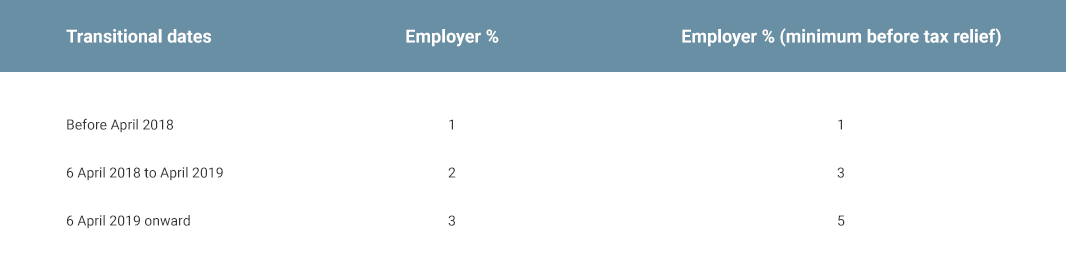

For a typical auto-enrolment scheme the increases are as follows (although firms can deviate from this and decide to increase their contributions):

The recent auto-enrolment review also recommended removing the lower earnings limit and reducing the age threshold for eligible workers from 22 to 18 — but neither of these further changes will be implemented until the mid-2020s.

Employees

The increased contributions probably won’t make a massive difference to your disposable income — they’ll be offset by increases in the national minimum wage and personal tax allowance.

But the changes could still significantly improve your financial position during retirement — if you earn the national average wage and have been saving under auto-enrolment since 2012, your pension could triple from £30,000 to £101,000.

And it’s worth noting that today’s workers will have to wait longer to receive their state pensions which, thanks to the single-tier structure, will be worth less.

So you should probably seriously consider voluntarily increasing your auto-enrolment contributions above the mandatory minimum level to further bolster your pension pot.

Choosing to save more cash now is a decision that you’re unlikely to regret in the future.

Employers

If you’re an employer, you should bear the following changes in mind to remain compliant with the new regime:

- You can choose to pay the total minimum contribution so staff don’t have any input, and you and your staff can also choose to pay more than the minimum.

- The increases don’t apply to defined benefit schemes.

And exclusions and exceptions apply to certain categories of workers.

If the scheme’s auto-enrolment contributions already meet the minimum rates that will take effect on April 6 2018 and/or the following April, you can relax — you’re already compliant.

And if you’ve not yet made the relevant changes for this April, raising your contributions now to meet the April 2019 rate is a wise move.

We hope that this article has put your mind at ease about the impending changes in auto-enrolment — but please get in touch if you’d like to discuss it in more detail.

And take a look at the following blogs for more financial management insights:

What changes to the Trusts Register do you need to be aware of?