Independent Analysis

At Chancellor we believe that clients funds should be invested within a framework where there is no bias or incentive to the adviser personally or our business as a whole and regardless of the route selected, they should be truly independent. We recommend our strategies based upon what we believe will provide the best outcome for our clients and the income that we receive will be the same regardless of our recommendations. In this way our interests are aligned exactly with those of our clients. Typically for larger amounts we will recommend the services of a separate, independent, investment manager whose sole job is to implement the investment strategy we have agreed with our clients as part of their financial plan, it is not appropriate for everybody, but we do believe that they can add value for many clients. We have identified six different Discretionary Fund Managers (DFM), whom we are comfortable will provide additional value to our clients through their involvement and the criterion for selection includes transparent and competitive charges, strong corporate governance and financial resources and a repeatable and understandable investment process.

DFMs are able to focus all of their resources on selecting the investments they believe fit the risk profile provided by Chancellor and have levels of expertise and access to information above that available to the majority of Independent Financial Advisers.

It is important to note that Chancellor do not receive any remuneration or other incentives from any of these organisations and part of our role is to ensure that the returns generated are in line with our expectations on an ongoing basis. We achieve this by monitoring all of the investment portfolios managed by each manager utilising a bespoke analysis tool that we have built within our business. This measures both the performance and the volatility experienced against a client specific benchmark, as well as against a peer group of other Discretionary Managers, not just the ones that we have within our current approved list, but also a wider industry based measurement.

The individual benchmark is set with reference to a client’s attitude to risk, objectives and requirements and their capacity to accept losses and volatility. It is carefully constructed and communicated to the selected manager and it is against this that he will be measured. To overlay this however, we double check that the benchmark is producing returns in line with expectations itself and therefore we use an industry benchmark produced by a company called Asset Risk Consultants (ARC) who provide a series of Indices against which we can also measure our client portfolios.

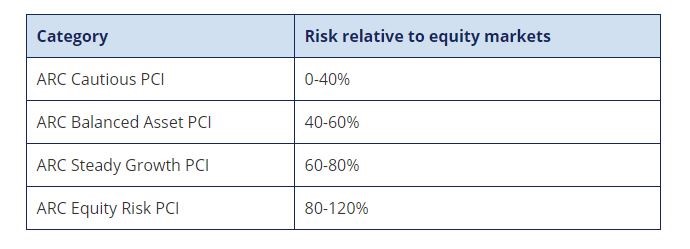

ARC is a company which compiles data from all major UK based DFMs to allow comparison for portfolios with a similar level of risk. The choice of benchmark is determined by the amount of equity risk in the portfolios and are broken down as follows:

As can be seen from the table the bands are quite wide and this can lead to a wide range of performance outcomes in the same category, we therefore use the fine tuning of the specific client benchmark and spend a great deal of time understanding what is in clients portfolios and the reasons for any deviation of returns and volatility. We formally review the performance of each DFM on a monthly basis and then in more detail with clients at their annual review. In the meantime, we produce a relatively straightforward report that we issue to all clients showing the performance of their portfolio, their individual benchmark and the most relevant ARC PCI to keep them informed.

It is our role to ensure the manager is providing a return which justifies the employment of their services on an ongoing basis, if the returns, or the volatility do not match our expectations then we have a scientific, fact based analysis of the details and are in the best place to understand why the performance is not what we would expect. Clearly, it is not an exact science and most fund managers are very eloquent and provide a strong defence to any challenge, we do not change managers lightly as we believe those that we have selected will genuinely provide strong returns at the outset, but where the performance ultimately disappoints we are able to demonstrate this to our clients and can recommend they move the funds to an alternative manager in a very cost effective and simple manner.

CAPITAL AT RISK — The material in this article is for information purposes only. Please ensure that you clearly understand the nature of any investments described and the potential risks relevant to them. Past performance is not a reliable indicator of future performance and the value of an investment and the income received from it can go down as well as up.

If you have any questions whatsoever about any of the areas covered in the article then please do not hesitate to get in touch with your usual Chancellor adviser on 01204 526 846