Octopus Booklets

With so many bank accounts, investments and policies now being operated purely online and the product providers no longer issuing paper statements, it can make it difficult (if not impossible) for a family to identify financial arrangements, should this become necessary. For example, if a loved one passed away or became incapacitated in some way, would their Executors, family or Attorneys know where to begin in piecing together the paperwork? It is a legal requirement to accurately reflect an individual’s assets when applying for Grant of Probate and therefore it is important to be able to do this if you have been appointed to act as an executor.

Most of Chancellor’s clients benefit from, amongst other services, review meetings which take place at least annually, ongoing valuations of their investment products and the ability to have 24-hour access to their financial information via the MyChancellor client portal. Regular readers of our ENews will be aware that the MyChancellor portal allows our clients to see an up to date valuation of their pension plans and investment products such as ISAs and investment bonds from a tablet, smartphone or personal computer, in an extremely secure way.

With the correct permissions, beneficiaries or Executors would be allowed access to MyChancellor in the event of death or disability. It should therefore provide a full picture of the financial position, as the system allows our client to add other financial information such as household and car insurance documents, which cannot be accessed by Chancellor. Therefore, all clients that use MyChancellor can build a comprehensive and up to date record of their financial arrangements. Even where access is not granted to others, in virtually every case Chancellor would be notified in the event of the client’s death or incapacity. We would then be able to provide the information within our records to the appropriate parties, to help with any exercise that is being undertaken.

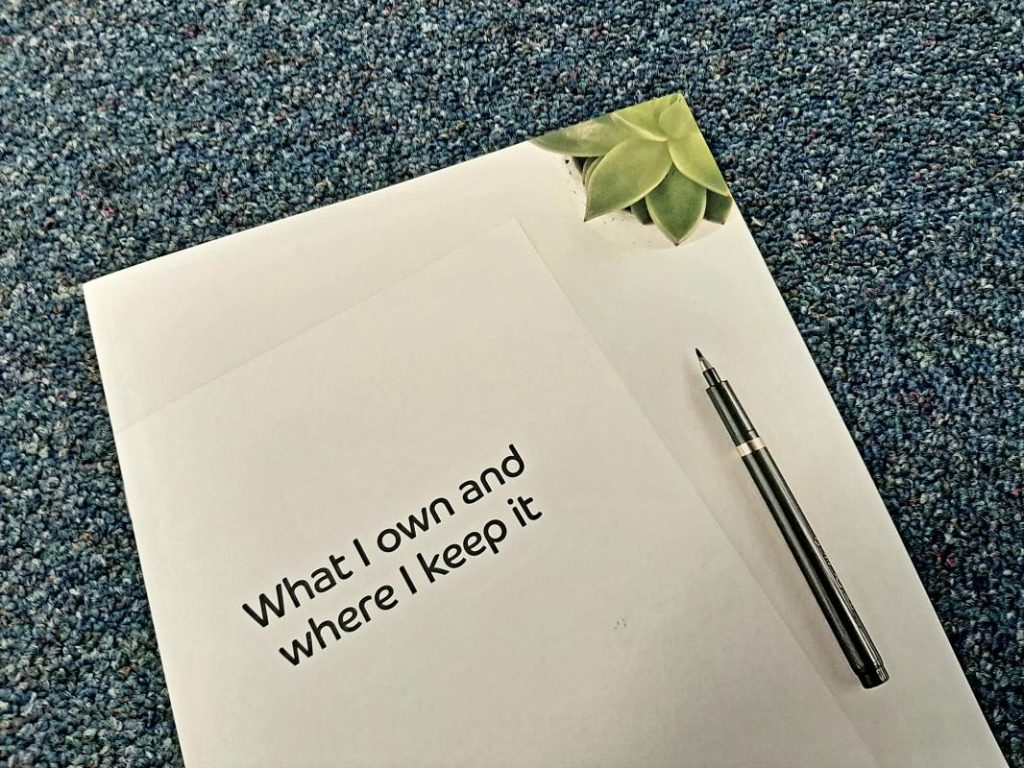

Clearly, not everyone uses the services of a qualified Financial Advisor such as Chancellor, so how can the representatives of these people access the necessary information? Our friends at Octopus Investments have recently produced a 12-page booklet called “What I own and where I keep it” in which it is possible for someone to list all the relevant financial information plus the contact details for their professional advisers, such as their lawyer and accountant. We believe it is an excellent document that can record all the appropriate information in one place to assist family members or Executors at the appropriate time. Chancellor have managed to secure a small supply of these documents and even where someone is not a client of ours, then they can request one from us to keep with their personal records. There is no requirement to provide any information to Chancellor; the document can simply be kept with the individual’s own records and accessed by their representatives when a need arises. If you would like one of these for yourself, a friend, relative or colleague, then please do not hesitate to give us a call. There is absolutely no cost or obligation in requesting one from us.

If you have any questions whatsoever about any of the areas covered in the article then please do not hesitate to get in touch with your usual Chancellor adviser on 01204 526 846